Forex trading, while potentially profitable, involves significant complexity. You the reader is most likely somewhat versed in this world. You may have taken a few trades here and there and you may have made and lost some money. But have you journaled your trading history properly?

You start off the day with a perfect 10.

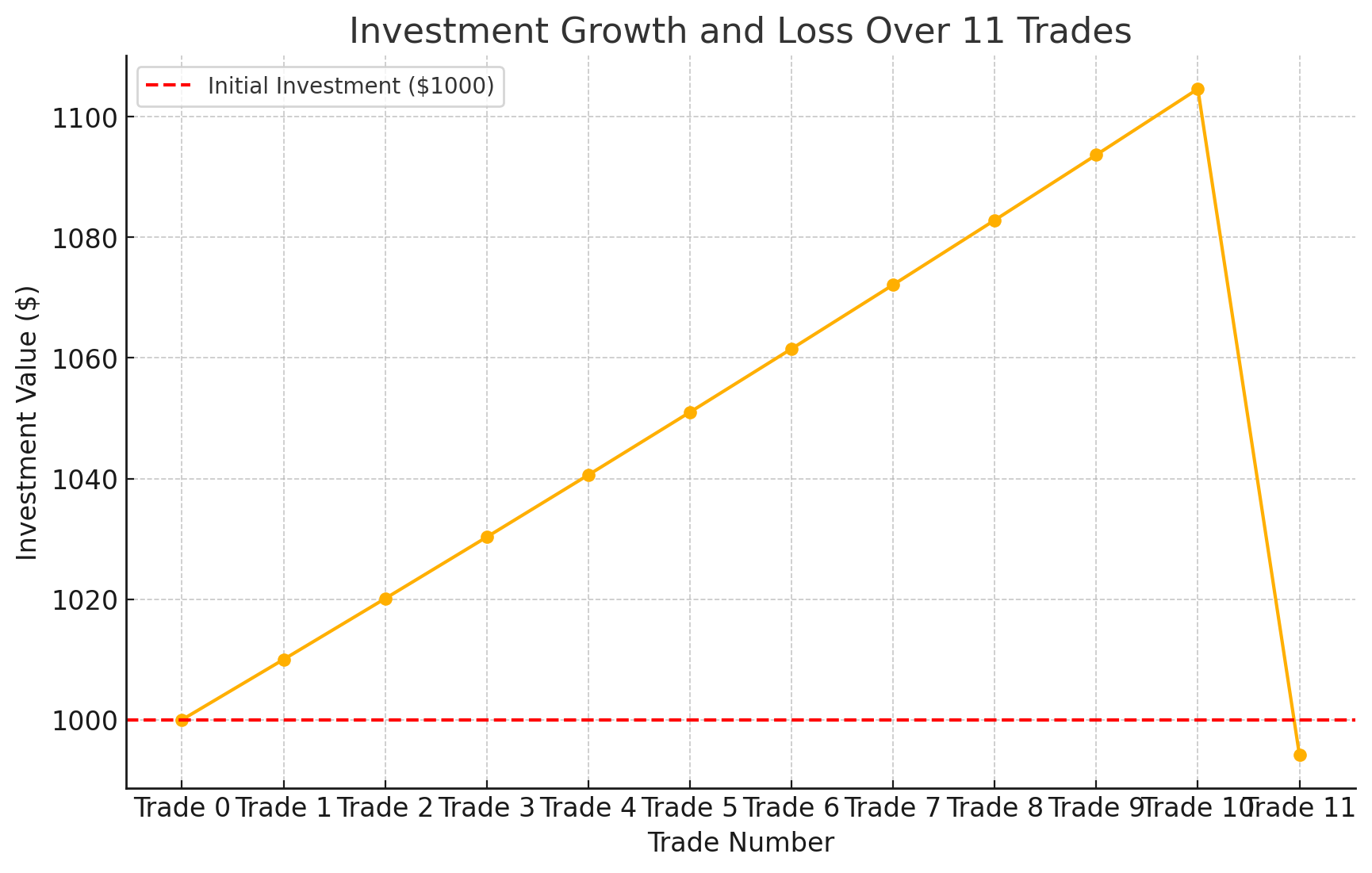

10 Trades in a row 10 of them are in the money and you have made a positive % increase from each of them. Let’s say for this example it was 1% on every trade with a starting investment of $1000. That’s about $104.62 increase from those 10 trades you made in the span of a few minutes/hours. It’s looking great so far but then you make that accursed 11th trade. Lo and Behold your 11th trade is now on a loss. Maybe you’ve forgotten to add a stop-loss or maybe you were too busy and didn’t properly do your Risk-Assessment. Whatever the reason, your previous profit of $104.62 is completely wiped. This 11th trade has turned into a 10% loss. Time to close the trade and look at the stats. Well how does that look like now?

You are now on a $5.84 loss from your original $1000 investment, down to $994.16.

Wait but if I only lost 10% on this trade how am I under my initial $1000 if I made a 10% cumulative profit in the day? Here comes the beauty of statistics.

10% from your $1104.62 is $110.41. That’s a loss that was greater than your initial increase of 10% from $1000 to $1104.62 bringing you down to $994.16.

Your Trade Winrate may be 90.91% but your Net Value is now -$5.84 less. And that’s not even taking into consideration the spread costs. All it takes is 1 bad trade to ruin 10 good ones. So stop focusing on your Winrate % and start looking at your overall Equity.

If YOU want to improve your Trading Mental and start having the right goals tracking the right Performance then feel free to Join our Waitlist and gain access to a community of traders with a focus on Indicators that provide real-time market insights, while experts take care of Technical execution and Mental management. This dual approach not only simplifies your trading experience but also enhances your ability to capitalize on market movements effectively. By leveraging our expertise, you gain access to premium tools and insights that can help bring your trading to the next level.