Forex, short for foreign exchange, is the global financial market where currencies are traded. It’s the largest and most liquid market in the world, with a daily trading volume of approximately $6.6 trillion. Forex trading allows individuals, businesses, and governments to exchange one currency for another. This market operates 24 hours a day, five days a week (24/5), and involves a network of banks, brokers, financial institutions, and individual traders.

A Real-Life Example

To understand forex, imagine you’re traveling to another country. Upon arrival at the airport, you visit a currency exchange booth to convert your money into the local currency. This simple act of exchanging one currency for another is a basic form of forex trading. For instance, if you’re an American visiting Japan, you would exchange your US dollars (USD) for Japanese yen (JPY). The exchange rate at that moment determines how much yen you get for your dollars.

Later, when you return to the exchange booth to convert your remaining yen back to dollars, you notice that the exchange rate has changed. These fluctuations in exchange rates are what drive the forex market and create opportunities for traders to make profits.

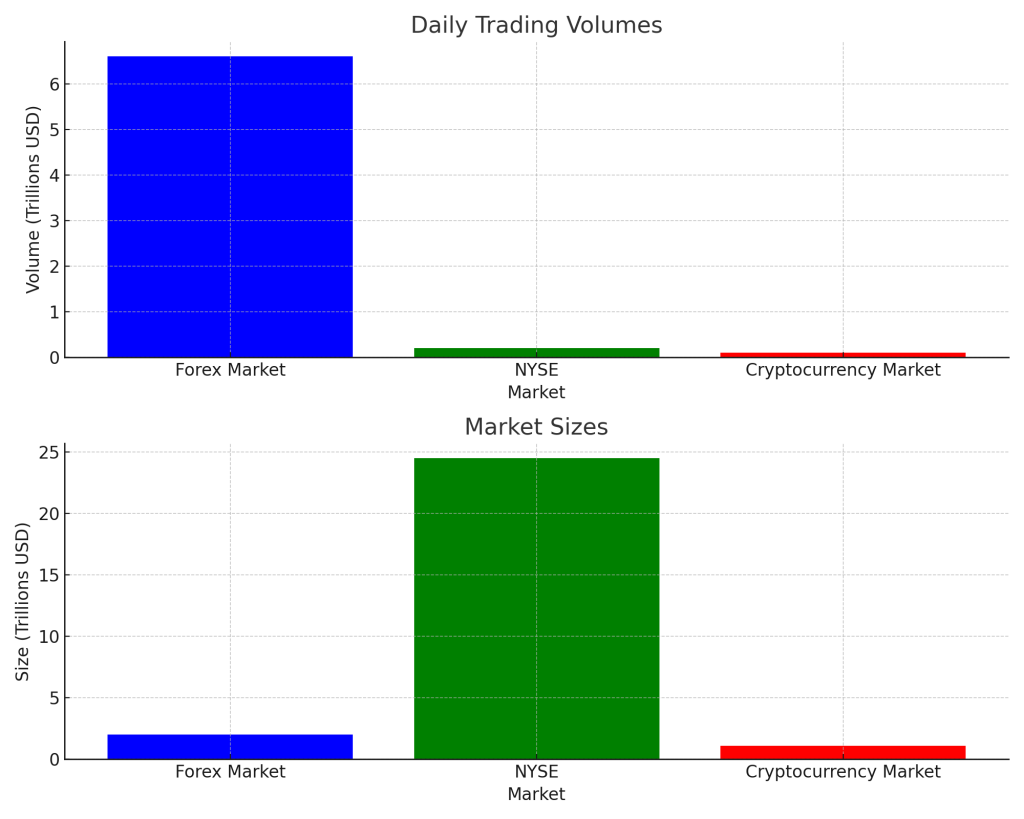

The Scale of the Forex Market

The forex market is massive, dwarfing other financial markets. To put it into perspective, the New York Stock Exchange (NYSE), the largest stock market in the world, has a daily trading volume of about $200 billion. In comparison, the forex market trades a staggering $6.6 trillion a day. This means the forex market is over 200 times larger than the NYSE.

However, it’s essential to note that the $6.6 trillion figure encompasses the entire global forex market. The “spot” market, which is the part of the forex market that most retail traders participate in, has a daily volume of about $2 trillion. Furthermore, the retail segment of the forex market is estimated to account for only 3-5% of the total daily trading volume, or around $200-300 billion.

Why is Forex Popular?

One of the key reasons forex is so popular is its accessibility. The market operates 24 hours a day, five days a week, allowing traders to participate at any time that suits them. This is unlike stock or bond markets, which have set trading hours and close at the end of each business day.

The forex market opens in New Zealand, then moves to Australia, Asia, Europe, and finally the United States, before the cycle begins anew in New Zealand. This continuous cycle ensures that there is always a market open somewhere in the world, providing ample opportunities for traders.

Speculation in the Forex Market

Most of the activity in the forex market is driven by speculation rather than by actual currency exchange for trade and tourism. Currency traders, also known as speculators, buy and sell currencies with the aim of making a profit from the changes in exchange rates. For example, if a trader believes that the euro will strengthen against the US dollar, they might buy euros and sell dollars. If the euro does appreciate, the trader can sell the euros back for a profit.

Comparing Forex with Other Markets

Forex stands out not only due to its size but also because of its liquidity and the opportunities it presents. The NYSE, though significant, appears small when compared to the forex market. Even the booming cryptocurrency market doesn’t come close to the sheer volume of the forex market.

Despite its vast size, the forex market’s liquidity ensures that large trades can be executed without causing significant price movements. This is crucial for traders who need to enter and exit positions quickly without facing substantial price shifts.

Retail forex trading has become increasingly popular, thanks in part to the rise of online trading platforms and brokers that offer access to the market. Retail traders, or individual investors, can trade currency pairs through these platforms, using leverage to amplify their potential profits. However, leverage also increases the risk, making it essential for traders to understand the mechanics and risks involved in forex trading.

Forex trading involves buying one currency while simultaneously selling another, which means that currencies are always traded in pairs. Some of the most commonly traded pairs include EUR/USD (euro/US dollar), USD/JPY (US dollar/Japanese yen), and GBP/USD (British pound/US dollar).

What is Traded in Forex?

In the vast world of forex trading, the simple answer to what is traded is money. More specifically, currencies. Forex trading might seem abstract since it doesn’t involve physical goods, but it’s fundamentally about exchanging one nation’s currency for another’s. This exchange is driven by the economic health, political stability, and overall market sentiment towards each country.

Understanding Forex Trading with an Analogy

To better grasp the concept, think of buying a currency like buying shares in a particular country. Just as the stock price of a company reflects the market’s view of its current and future profitability, the value of a currency reflects the market’s perception of the health of its respective economy.

For instance, if you buy Japanese yen (JPY), you are essentially investing in the Japanese economy. You’re betting that Japan’s economy will perform well and its currency will strengthen. If your bet is correct, and the yen appreciates, you can sell it back to the market for a profit. This concept applies across all currencies in the forex market.

Major Currencies in Forex Trading

While there are many currencies you can trade, new traders typically start with the “major currencies.” These are the most heavily traded currencies in the world, representing some of the largest economies. They include:

- USD (United States Dollar) – Nicknamed “Buck”

- EUR (Eurozone Euro) – Nicknamed “Fiber”

- JPY (Japanese Yen) – Simply known as “Yen”

- GBP (British Pound) – Nicknamed “Cable”

- CHF (Swiss Franc) – Nicknamed “Swissy”

- CAD (Canadian Dollar) – Nicknamed “Loonie”

- AUD (Australian Dollar) – Nicknamed “Aussie”

- NZD (New Zealand Dollar) – Nicknamed “Kiwi”

These currencies are popular because they are stable, highly liquid, and widely traded, making them the foundation of the forex market.

Currency Symbols and Codes

Each currency is identified by a three-letter code, known as the ISO 4217 Currency Codes, established by the International Organization for Standardization in 1973. The first two letters of the code denote the country, and the third letter represents the currency. For example, NZD stands for New Zealand Dollar.

The Role of Major Currencies

Major currencies are crucial in the forex market because they are the most traded. This high trading volume provides liquidity, ensuring that trades can be executed quickly and with minimal price impact. The major currencies also serve as benchmarks for the global economy, influencing financial markets worldwide.

Interesting Facts:

- The British pound (GBP) is the oldest currency still in use today, dating back to the 8th century. On the other hand, the newest currency is the South Sudanese pound, which became official on July 18, 2011.

- While “buck” is the most common nickname for the US Dollar (USD), it has many others, including greenbacks, bones, benjis, benjamins, cheddar, paper, loot, scrilla, cheese, bread, moolah, dead presidents, and cash money. These nicknames reflect the cultural significance and widespread use of the dollar.

What is Forex Trading?

Forex trading, or foreign exchange trading, is the simultaneous buying of one currency and selling of another. This trading is conducted through forex brokers or CFD (Contract for Difference) providers and involves currency pairs. Currencies are always quoted in relation to another currency, forming pairs such as the euro and the US dollar (EUR/USD) or the British pound and the Japanese yen (GBP/JPY).

Understanding Currency Pairs

When you trade in the forex market, you buy or sell in currency pairs. Imagine each currency pair constantly in a tug of war, with each currency on its own side of the rope. An exchange rate is the relative price of two currencies from two different countries. These rates fluctuate based on which currency is stronger at any given moment.

Categories of Currency Pairs

There are three main categories of currency pairs:

- Majors: These always include the US dollar (USD) and are the most frequently traded pairs.

- Crosses: These do not include the USD and involve major currencies paired against each other.

- Exotics: These consist of one major currency and one currency from an emerging market.

Major Currency Pairs

The major currency pairs, which include the USD on one side, are the most liquid and heavily traded. These pairs provide more trading opportunities due to their frequent price movements. The seven major currency pairs are:

- EUR/USD (Eurozone / United States): “euro dollar”

- USD/JPY (United States / Japan): “dollar yen”

- GBP/USD (United Kingdom / United States): “pound dollar”

- USD/CHF (United States / Switzerland): “dollar swissy”

- USD/CAD (United States / Canada): “dollar loonie”

- AUD/USD (Australia / United States): “aussie dollar”

- NZD/USD (New Zealand / United States): “kiwi dollar”

These pairs are the most liquid in the world, meaning they have the highest level of trading activity and volume. Liquidity in forex is crucial as it determines how easily a currency can be bought or sold without affecting its price.

Major Cross-Currency Pairs (Minors)

Currency pairs that include any two of the major currencies except the USD are known as cross-currency pairs or simply “crosses.” Major crosses, also known as minors, are still quite liquid and offer numerous trading opportunities. Some of the most actively traded crosses are derived from the euro (EUR), Japanese yen (JPY), and British pound (GBP).

Examples of Major Crosses

Euro Crosses:

- EUR/CHF (Eurozone / Switzerland): “euro swissy”

- EUR/GBP (Eurozone / United Kingdom): “euro pound”

- EUR/CAD (Eurozone / Canada): “euro loonie”

- EUR/AUD (Eurozone / Australia): “euro aussie”

- EUR/NZD (Eurozone / New Zealand): “euro kiwi”

Yen Crosses:

- EUR/JPY (Eurozone / Japan): “euro yen” or “yuppy”

- GBP/JPY (United Kingdom / Japan): “pound yen” or “guppy”

- CHF/JPY (Switzerland / Japan): “swissy yen”

- CAD/JPY (Canada / Japan): “loonie yen”

- AUD/JPY (Australia / Japan): “aussie yen”

- NZD/JPY (New Zealand / Japan): “kiwi yen”

Pound Crosses:

- GBP/CHF (United Kingdom / Switzerland): “pound swissy”

- GBP/AUD (United Kingdom / Australia): “pound aussie”

- GBP/CAD (United Kingdom / Canada): “pound loonie”

- GBP/NZD (United Kingdom / New Zealand): “pound kiwi”

Exotic Currency Pairs

Exotic currency pairs consist of one major currency and one currency from an emerging market, such as Brazil, Mexico, or Turkey. These pairs are less liquid and more volatile, often influenced by economic and geopolitical events. This volatility can lead to wider spreads, making exotic pairs more expensive to trade.

Examples of exotic currency pairs include:

- USD/BRL (United States / Brazil): “dollar real”

- USD/HKD (United States / Hong Kong)

- USD/SAR (United States / Saudi Arabia): “dollar riyal”

- USD/SGD (United States / Singapore): “dollar sing”

- USD/ZAR (United States / South Africa): “dollar rand”

- USD/THB (United States / Thailand): “dollar baht”

- USD/MXN (United States / Mexico): “dollar mex”

- USD/RUB (United States / Russia): “dollar ruble” or “Barney”

- USD/PLN (United States / Poland): “dollar zloty”

- USD/CLP (United States/ Chile)

These pairs are more sensitive to economic and political events, which can lead to significant price swings. Traders need to be cautious when trading exotics and consider these factors when making decisions.

Forex Market Size and Liquidity

The forex market, or foreign exchange market, is the largest and most liquid financial market in the world. It operates as an over-the-counter (OTC) market, meaning it has no physical location or central exchange. Instead, it functions through a network of banks, financial institutions, and individual traders, all connected electronically over a 24-hour period.

The Interbank Market

The bulk of forex trading occurs on what is known as the “interbank market.” This decentralized market allows trades to happen globally, at any time, and from any location with an internet connection. Unlike other financial markets like the New York Stock Exchange (NYSE) or the London Stock Exchange (LSE), the forex market’s lack of a central location enables continuous trading, moving from one major financial center to another across different time zones.

Forex Interbank Network

In the interbank market, participants can choose their trading counterparts based on various conditions such as trading terms, price attractiveness, and the reputation of the counterparty. This flexibility and vast network make the forex market highly efficient and accessible.

Currency Distribution in Forex Market

The forex market involves trading pairs of currencies. The U.S. dollar (USD) is the most traded currency, accounting for 84.9% of all transactions. The euro (EUR) follows at 39.1%, and the Japanese yen (JPY) at 19.0%. These major currencies dominate the market, reflecting their significant role in global trade and finance.

The Dominance of the U.S. Dollar

The USD holds a pivotal position in the forex market for several reasons:

- Largest Economy: The United States has the largest economy in the world, making the USD a benchmark for global trade and finance.

- Reserve Currency: The USD is the primary reserve currency, comprising roughly 62% of the world’s official foreign exchange reserves, according to the International Monetary Fund (IMF).

- Financial Markets: The U.S. boasts the largest and most liquid financial markets globally.

- Political Stability: The political stability of the United States adds to the USD’s attractiveness.

- Military Superpower: The U.S. is the world’s sole military superpower, further reinforcing confidence in its currency.

- Medium of Exchange: The USD is widely used for international trade transactions, including pricing of commodities like oil, often referred to as “petrodollars.”

The extensive use of the USD for international loans and bonds, and as a medium of exchange, underscores its critical role in the global economy. This dependency on the USD ensures a continuous demand for the currency, maintaining its dominance in the forex market.

Functions of the Forex Market

The forex market serves several essential functions:

- Funds Transfer: Facilitates the transfer of funds from one currency to another.

- Trade Financing: Provides short-term credit to finance trade between countries.

- Hedging: Allows participants to hedge against foreign exchange rate fluctuations.

- Speculation: Enables speculation on currency price movements.

Speculation and Liquidity

Speculation constitutes a significant portion of forex trading volume, with estimates suggesting that over 90% of transactions are speculative. This speculation involves traders buying and selling currencies based on short-term price movements, contributing to the market’s high liquidity.

Market Liquidity

Liquidity refers to the ability to buy or sell large quantities of an asset with minimal price impact. In the forex market, high liquidity ensures that transactions can be executed swiftly and efficiently, with little effect on the currency’s price. This liquidity is vital for traders, especially those engaged in short-term trading, as it allows for rapid entry and exit from positions.

The high liquidity of the forex market has numerous benefits, including:

- Price Stability: High liquidity helps stabilize prices, reducing the impact of large transactions on the market.

- Cost Efficiency: Lower transaction costs due to tighter spreads between buying and selling prices.

- Market Efficiency: Enhances the overall efficiency of the market, making it easier to execute trades at desired prices.

Trading Sessions and Market Depth

While the forex market is highly liquid, market depth can vary depending on the currency pair and the time of day. Different trading sessions (such as the Tokyo, London, and New York sessions) can influence the liquidity and volatility of currency pairs. Understanding these sessions and their impact on market conditions is crucial for traders.

Participating in the forex market involves trading currencies in pairs through various financial instruments. Let’s explore the different ways individual traders can engage in forex trading.

Retail Forex

Retail forex trading is accessible to individual traders through forex brokers or CFD (Contract for Difference) providers. These brokers offer platforms where traders can buy and sell currencies with leverage, allowing control over large positions with a small amount of capital.

Spot FX

The spot FX market is an “off-exchange” market, also known as an over-the-counter (OTC) market. In this market, trades are conducted directly between parties without a centralized exchange. Most transactions occur through electronic trading networks. Spot FX involves agreements to exchange currencies at the current market rate, with settlement occurring typically within two business days (T+2).

Currency Futures

Currency futures are contracts to buy or sell a currency at a specified price on a future date. Created by the Chicago Mercantile Exchange (CME) in 1972, these standardized contracts are traded on centralized exchanges, providing transparency and regulation.

Currency Options

Currency options give traders the right, but not the obligation, to buy or sell a currency at a predetermined price on the option’s expiration date. These options are traded on exchanges like CME, ISE, and FXMeridian, though they have limited market hours and liquidity compared to spot FX and futures.

Currency ETFs

Currency exchange-traded funds (ETFs) offer exposure to a single currency or a basket of currencies. Managed by financial institutions, these funds are traded on stock exchanges, allowing traders to speculate on currency movements without directly trading forex.

Forex CFDs

Contracts for Difference (CFDs) are financial derivatives that allow traders to speculate on the price movements of currency pairs. CFDs mirror the price of the underlying asset, enabling traders to take long or short positions without owning the actual currency. In the EU and UK, rolling spot FX contracts are considered CFDs due to their speculative nature.

Forex Spread Betting

Spread betting on forex involves speculating on the price direction of currency pairs without owning the underlying asset. Profits or losses are determined by how far the market moves in the trader’s favor and the amount wagered per point of movement. Spread betting is popular in the UK but illegal in the U.S.

To Recap:

- Forex Market Overview:

The forex market is the largest and most liquid financial market globally, with a daily trading volume of approximately $6.6 trillion.

It operates as a decentralized over-the-counter (OTC) market, functioning 24 hours a day, five days a week, through a network of banks, brokers, and financial institutions.

2. What is Traded in Forex?:

In forex trading, currencies are the primary assets traded. Currencies are always traded in pairs, reflecting the relative value of one currency against another.

Major currency pairs involve the US dollar and other leading currencies like the euro, yen, and pound. Cross-currency pairs exclude the US dollar, and exotic pairs include one major currency and one from an emerging market.

3. How Forex Trading Works:

Forex trading involves buying one currency while simultaneously selling another, facilitated through forex brokers or CFD providers.

Trades are conducted in various currency pairs, with major pairs offering high liquidity and frequent trading opportunities.

4. Forex Market Size and Liquidity:

The forex market’s size and liquidity make it unique, enabling large trades with minimal price impact. The market’s decentralized nature allows continuous trading across different time zones.

The US dollar dominates the market, serving as the primary reserve currency and the most traded currency, underscoring its global economic importance.

5. Methods of Trading Forex:

Traders can engage in the forex market through several financial instruments, including: spot FX, currency futures, options, ETFs, CFDs, and spread betting.

Each method offers distinct advantages and caters to different trading strategies and risk appetites. Retail traders typically use leverage to control larger positions with smaller capital investments.

Main Conclusion:

The forex market is a vast, dynamic, and highly liquid financial market that offers diverse opportunities for traders worldwide. Its decentralized nature, continuous operation, and the dominance of major currencies, especially the US dollar, highlight its critical role in global finance. Traders can participate through various instruments, each with unique characteristics and benefits, allowing for tailored trading strategies. Understanding the mechanics, instruments, and market conditions is crucial for successful forex trading, making it a unique and accessible market for both individual and institutional participants.