Introduction

Understanding and mastering leverage and positioning in forex trading are crucial for any forex trader aiming for consistent success. This guide delves into these important concepts, offering practical insights and strategies to help you trade more effectively.

What is Forex Trading?

Forex trading, also known as foreign exchange trading, involves buying and selling currencies on the forex market to make a profit. The forex market is the largest and most liquid market in the world, with a daily trading volume exceeding $6 trillion. Traders use forex to speculate on currency movements, hedge against currency risks, and diversify their investment portfolios.

Understanding Leverage in Forex Trading

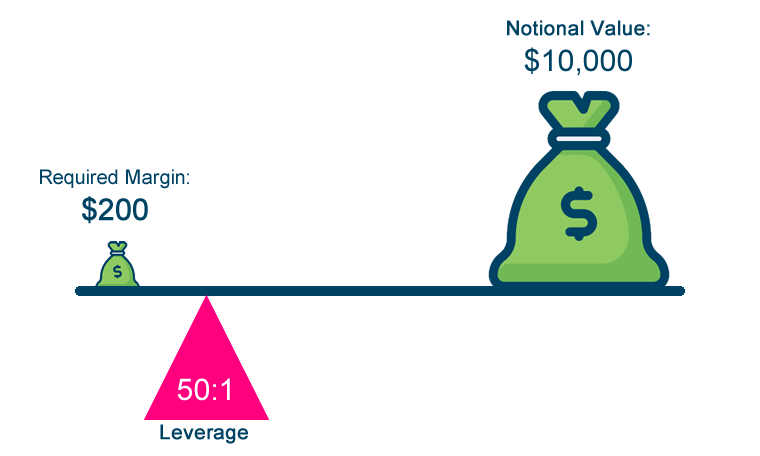

Understanding leverage in forex trading is important for making more money and controlling risks. Forex trading leverage lets you handle bigger trades with less money, which can increase both profits and losses. To manage leverage well, you need to understand how the market works and use smart trading strategies.

How Leverage Works

Leverage is expressed as a ratio, such as 50:1 or 100:1. This means that for every dollar in your account, you can trade 50 or 100 dollars’ worth of currency. For example, with 100:1 leverage, a $1,000 deposit allows you to control a $100,000 position.

Benefits of Using Leverage

1. Increased Buying Power:

Leverage in forex trading empowers traders by allowing them to open positions that exceed their account balance. This capability amplifies their trading potential and enables them to take advantage of opportunities they might otherwise miss due to limited capital.

2. Enhanced Profit Potential:

With leverage, traders can capitalize on larger positions, potentially maximizing profits when the market moves favorably. This increased exposure to market movements enhances the potential for significant gains, aligning with strategic trading objectives and risk management practices.

Risks of Using Leverage

1. Magnified Losses:

Leverage also amplifies losses. A small adverse price movement can lead to significant losses, potentially exceeding the initial investment.

2. Margin Calls:

If the market moves against your position, you may receive a margin call from your broker, requiring you to deposit more funds or close your positions.

Position Sizing in Forex Trading

Position sizing in Forex trading means calculating appropriate trade units or lots in line with the level of risk that one is willing to take on any single trade. In this manner, this strategic approach is taken to ensure effective risk management and protection of the trading capital held. By deriving the best position size, traders can control possible losses and enhance their overall trading strategy.

Determine Account Risk

Again, this is simply determining what percent of your total capital this amounts to. The retail investor usually will not risk more than 2% of his investment capital on any one trade. As an example, you should have a $25,000 account and determine 2% as your maximum risk, then you would allow for no more than $500 per trade. This meticulous strategy also means that even if you experience a series of losses, your account will be safeguarded.

How to Calculate Trade Risk

Trade risk is about placing a stop-loss order to minimize the downside of a trade. The money between the intended entry price and the stop-loss price is called the trade risk. As a hypothetical example, say you are long Apple Inc. at $160, with a stop-loss price of $140. In this case, your risk per share is $20. You need to take this step because it informs you of the maximum amount you want to lose on any single trade, which will, therefore, protect you from losing too much money when things go awry.

Determining Proper Position Size

To determine your position size, you must divide your account risk by trade risk. In this example, to be able to risk $500 per trade with the risk of your trade being $20 per share, you would be able to buy 25 shares. This formula keeps your account from overexposing in a single trade, balancing the risk-reward

Position Sizing in Various Market Conditions

Position sizing is crucial for traders who move quickly, like day traders and currency traders. They navigate volatile markets and need to manage risk carefully. In forex trading, where markets can change rapidly and leverage plays a big role, getting the position size right can mean the difference between steady profits and significant losses.

Combining Leverage and Position Sizing

When used together, leverage and position sizing allow traders to optimize their trading strategy. Here are some key considerations:

1. Fixed Position Size: Maintain a consistent position size regardless of the leverage used.

2. Leverage Control: Use leverage judiciously to avoid overexposing your account to risk.

Practical Example of Leverage and Position Sizing

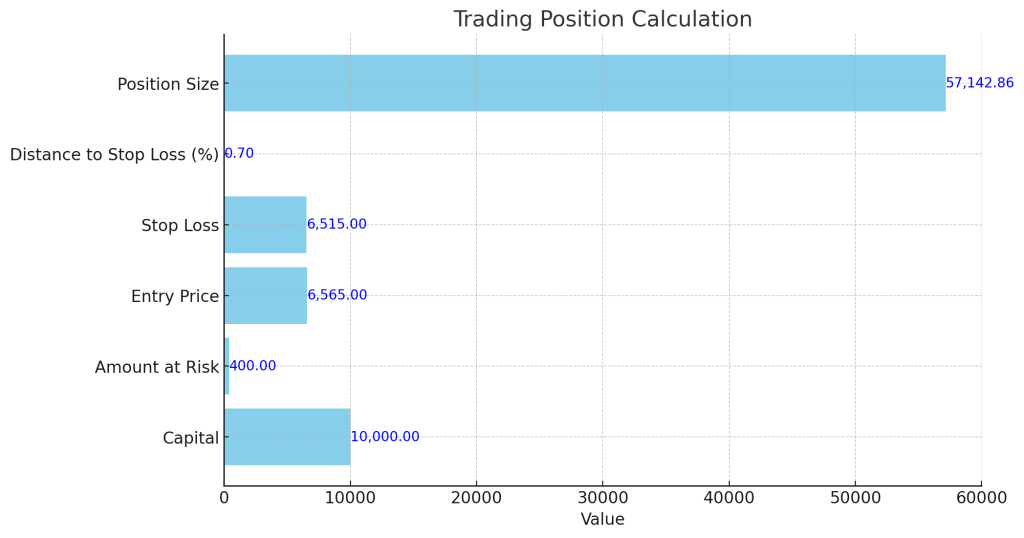

– Capital: $10,000

– Amount at Risk: 4% of the capital = $400

– Entry Price: 6565

– Stop Loss: 6515

– Distance to Stop Loss: 0.70%

To calculate the position size:

Position Size = Risk Amount / Distance to Stop Loss

For example:

Position Size = $400 / 0.007

Position Size = 57,143 contracts

The size of this position is fixed. The amount of capital required to open this position depends on the leverage used. Greater leverage means less capital to put up, but it also means greater risk. Always ensure stop-loss triggers before liquidation to manage risk adequately.

Trade Entry Checklist

Here is a step-by-step checklist to follow when entering a trade:

1. Capital Definition: What is your total trading capital?

2. Set Risk Percentage: How much of your capital are you willing to risk?

3. Determine Risk Amount: Total capital x percentage of risk.

4. Define Entry and Stop Loss: What is your entry price and stop-loss price?

5. Calculate Distance to Stop Loss: The percentage distance from your entry to stop loss.

6. Determine Position Size: Risk Amount / Distance to Stop Loss.

7. Leverage Calculator: Ensure that stop-loss is set to execute before liquidation.

This checklist provides a systematic approach to trading, ensuring that all important aspects are considered before entering a trade.This checklist can help prevent emotional decision-making and maintain a disciplined trading strategy.

Position Sizing and Gap Risk

Investors should be aware that even if they use correct position sizing, they may lose more than their specified account risk limit if a stock gaps below their stop-loss order. Gaps can occur due to unexpected news or events that cause significant price changes when the market is closed. To mitigate this risk, consider the following strategies:

Halve Position Size: If increased volatility is expected, such as before company earnings announcements, halving your position size can reduce gap risk.

Avoid Trading Before News: Refrain from entering new positions before major news events to avoid unexpected price movements.

Use Options: For stocks, consider using options as a hedge against potential gaps.

Diversifying Your Trades

Diversification is a key principle in risk management, helping traders mitigate potential losses. By spreading investments across different assets or currency pairs, traders can reduce the impact of a single losing trade on their overall portfolio. Here’s how to implement diversification:

Multiple Currency Pairs: Instead of focusing solely on one or two currency pairs, consider trading a basket of currencies. This approach helps protect against volatility in any single market.

Different Trading Strategies: Employ various trading strategies such as trend following, scalping, and swing trading. Different strategies perform better under different market conditions, balancing out your risk.

Varying Time Frames: Use multiple time frames in your analysis. Short-term trades can capture quick market movements, while long-term trades can benefit from broader market trends.

Strategies to Manage Leverage and Positioning

Effective risk management involves using leverage and position sizing to control your exposure and protect your capital. Here are some strategies:

Hedging

Hedging involves opening positions in different currency pairs to offset potential losses. For example, if you are long on EUR/USD, you might hedge by taking a short position on GBP/USD.

Diversification

Diversifying your trades across different currency pairs and strategies helps spread risk and reduce the impact of a single losing trade.

Risk-Reward Ratio

Always aim for a favorable risk-reward ratio. A common ratio is 1:3, meaning you risk $1 to potentially make $3.

Psychological Aspects of Trading

Trading is not just a numbers game; it also involves significant psychological challenges. Emotional control and discipline are essential for consistent success. Here are some tips to manage the psychological aspects of trading:

Stick to Your Plan: Develop a detailed trading plan and adhere to it strictly. This reduces the likelihood of making impulsive decisions based on emotions.

Accept Losses: Understand that losses are a natural part of trading. Accepting this can help you maintain emotional equilibrium and avoid the temptation to chase losses.

Regular Breaks: Take regular breaks to clear your mind. Trading continuously without breaks can lead to fatigue and poor decision-making.

If you want to be more better in understanding of trading strategies and risk management, check out this article Emotional Reminders for Trading.

Utilizing Technology in Trading

Technology can really boost your trading strategy and execution. Here are some tools that can make a big difference:

Automated Trading Systems

Automated systems execute trades based on your pre-set criteria, reducing emotional bias and ensuring you stick to your plan. These systems can be a game-changer for keeping your trading disciplined. Find out more about automated trading systems here.

Trading Platforms

Robust trading platforms come with advanced charting tools, real-time data, and various order types to enhance your trading. Having the right platform can give you the edge you need in today’s fast-paced trading world. Check out our top recommended trading platforms here.

By using the right tools and strategies, you can navigate the ups and downs of forex trading with more confidence. Explore different trading solutions and platforms to see what works best for your trading style and goals.

Continuous Learning and Adaptation

The forex market is dynamic, and continuous learning is essential. Here are some ways to stay ahead:

1. Educational Resources: Read books, articles, and research papers on trading strategies and market analysis.

2. Webinars and Workshops: Participate in webinars and workshops conducted by market experts.

3. Networking: Join trading communities and forums to exchange ideas and experiences.

Conclusion

Mastering leverage and positioning in forex trading is essential for managing risk and maximizing returns. By understanding and applying these concepts effectively, traders can enhance their trading strategies and achieve greater success in the forex market.

Join our lively Discord community now! Secure your spot among the first 700 members, and gain early access to exclusive updates and valuable insights on Forex trading. .