Shield your money from inflation and instability

Introduction:

The Financial Markets in the world are reacting negatively to the current geopolitical tensions in the Middle East.

When instability hits the Middle East – Gold & Oil reign supreme. Why? Because the Middle East region has its vast reserves of oil and its strategic location. However, the region is also prone to conflict and political instability, which can have far-reaching implications for global markets. In recent years, escalating tensions in the region—ranging from civil wars to international conflicts—have contributed to fluctuations in commodity prices, particularly oil and gold.

More recently the US has accelerated it’s military deployment to the region amid reports Iran may attack within days – as it happened.

While the west is crying for a ceasefire the tensions just keep rising with more and more military deployment on both the Israeli and Iranian front

As tensions rise, fears of supply disruptions and economic sanctions have led to increased volatility in oil prices. Similarly, the uncertainty surrounding these conflicts often drives investors to seek the safety of gold, pushing its prices upward. This dynamic underscores the importance of these commodities as hedges against broader economic and geopolitical risks.

Gold: The Best Hedge Against Inflation

Gold has been positive during recession:

Gold has long been regarded as a safe-haven asset, particularly during periods of inflation and economic instability. Unlike fiat currencies, which can lose value due to inflation, gold maintains its purchasing power over time. This is because gold is a tangible asset with intrinsic value, making it less susceptible to the devaluation that can affect paper currencies.

During times of crisis, such as the current war situation in the Middle East, investors often flock to gold as a store of value. This increased demand can drive up gold prices, providing a buffer against inflation. Moreover, gold’s historical performance shows that it tends to outperform other asset classes during periods of high inflation, making it an essential component of any diversified portfolio.

For example:

During the 1970s, a period marked by high inflation and geopolitical turmoil, gold prices soared. Similarly, during the 2008 financial crisis, gold again proved its worth as a hedge against economic instability. In today’s context, with rising inflation and ongoing tensions in the Middle East, gold is once again demonstrating its value as a reliable store of wealth.

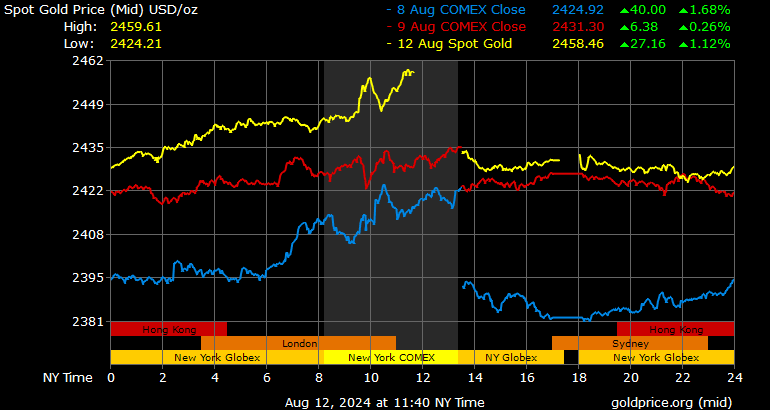

It has been a positive day (8/12/24) so far for precious metals with gold and silver both rising thanks to an improving appetite for safety following the mini turmoil last Monday.

Gold’s ability to surpass the shaded grey zone on the chart, which ranges from $2431 to $2450 and represents the highs from April and May, indicates that a new all-time high above July’s peak of $2483 seems likely.

If gold achieves this new high, we think this will positively influence silver’s price action.

Non-Standard way to Invest in Gold's Value

Sometimes a shovel is better than an ingot:

Investing in the stock of companies that mine, refine and trade gold rather than gold itself can be a much more straightforward proposition than buying physical gold. Since this means buying the stocks of gold mining companies, you can invest using your brokerage account.

Some of the most popular stocks in this sector include:

- Newmont Corp. (NEM). Newmont is the world’s largest gold mining company, headquartered in Colorado. It operates mines in North and South America as well as Africa.

- Barrick Gold Corp. (GOLD). This gold mining giant is headquartered in Toronto and operates in 13 countries around the world.

- Franco-Nevada Corp. (FNV). Franco-Nevada doesn’t own any gold mines. Instead, it buys the rights to royalties from other gold miners.

Keep in mind, though, that the shares price of gold companies aren’t always correlated with just gold prices but also are based on fundamentals related to the company’s current profitability and expenses. This means investing in individual gold companies carries similar risks as investing in any other stock. Single stocks may experience a certain level of volatility and do not provide you with the security of diversified funds.

Investing using ETFs and Mutual Funds for GOLD

The safest bet:

Investing in gold ETFs and mutual funds offers a way to gain exposure to gold’s long-term stability while providing greater liquidity than physical gold and more diversification than individual gold stocks. There are various types of gold funds available. Some are passively managed index funds that track industry trends or the price of gold through futures or options.

For example, the SPDR Gold Shares ETF (GLD) holds physical gold and deposit receipts, with its price closely tracking that of physical bullion. In contrast, the VanEck Vectors Gold Miners ETF (GDX) is a passively managed fund that tracks a portfolio of stocks from gold mining and refining companies.

Gold mutual funds, such as Franklin Templeton’s Gold and Precious Metals Fund, are actively managed by professional investors with the goal of outperforming passively managed index funds. These funds typically have higher expense ratios in exchange for active management.

It’s important to note that, similar to gold stocks, these investments represent ownership of financial instruments like debt, equity in mining companies, or futures and options contracts tied to physical gold. As a result, the value of gold mutual funds and ETFs may not perfectly align with the market price of gold, and their performance may differ from that of holding physical gold.

The safest bet:

Oil is another commodity that plays a critical role in the global economy, and its price movements can have significant implications for inflation and economic stability. As the lifeblood of industrial economies, oil prices are closely tied to global economic growth and supply-demand dynamics. When geopolitical tensions threaten oil supplies, prices can spike, leading to higher costs for goods and services, which in turn fuels inflation.

The Middle East, home to some of the world’s largest oil producers, has a significant influence on global oil prices. Any disruption in the region’s oil supply—whether due to conflict, sanctions, or other factors—can lead to sharp increases in oil prices. This, in turn, can contribute to inflationary pressures worldwide, as higher oil prices increase the cost of transportation, manufacturing, and energy.

Investing in oil, whether through direct investments in oil companies or through commodities futures, can therefore serve as a hedge against inflation. When oil prices rise, the value of these investments typically increases, helping to offset the impact of higher costs elsewhere in the economy.

Investing in Oil during a crisis

Do it properly with a trusted broker:

There are numerous ways to gain exposure to oil markets, but it’s important to recognize that oil carries its own set of unique risks that traders and investors should understand.

The good news is, you don’t need to buy an oil well or invest a large amount of money to get started with oil trading and investing. Oil futures, oil-related stocks, and oil-focused funds provide accessible options for beginners to trade and invest in petroleum products—without the need to pack up and move to the Middle East.

What is Oil as an asset class?

When investing in oil, investors typically don’t take physical possession of the commodity itself, unlike stock investing, where shares represent ownership in a company. Instead, investing in oil is often referred to as “gaining exposure” to oil because it involves financial instruments linked to the commodity rather than direct ownership.

The approach you take to gain exposure to oil will depend on your risk tolerance and whether you’re comfortable with direct exposure to oil as a commodity. Fortunately, you can access various types of oil-related investments through an online brokerage account.

Brent Crude is the primary benchmarks used to price oil. Brent Crude, sourced from oil fields in the North Sea between the Shetland Islands and Norway, serves as the benchmark for the light oil market across Europe, Africa, and the Middle East. On the other hand, West Texas Intermediate is the benchmark for the U.S. light oil market and comes from U.S. oil fields.

Both Brent Crude and WTI are classified as light and sweet, which makes them ideal for refining into gasoline.

Brent Crude is more widely used as a global benchmark, influencing the pricing of roughly two-thirds of the world’s oil. Its proximity to the ocean means lower shipping costs. In contrast, West Texas Intermediate, produced in landlocked regions of the U.S., incurs higher transportation costs due to its location..

Supply & Demand in the Petroleum Markets

Like any other investment, the value of oil is heavily influenced by supply and demand dynamics. Currently, our society relies on oil for numerous essential activities, from commuting to heating homes. However, this demand could shift in the future due to various factors. The rise of renewable energy sources like wind and solar, the global availability of oil, and geopolitical conflicts affecting oil production all contribute to changes in the supply and demand for oil.

Investors in the oil and gas sector monitor specific economic indicators to anticipate future trends in the petroleum industry.

Oil is a finite resource, meaning it will eventually be depleted. As the available supply decreases and our reliance on it remains high, demand could potentially increase, driving up prices.

In addition to supply and demand, another factor influencing oil prices is the activity of investors and speculators in the oil futures market. Many large institutional investors, such as pension and endowment funds, include commodity-linked investments as part of their long-term portfolio strategies. Meanwhile, speculators often trade oil futures over short periods to capitalize on price fluctuations. Some experts believe that these speculative activities can cause significant short-term volatility in oil prices, while others argue that their impact is limited.

It’s important to remember that oil prices can fluctuate in either direction, leading to potential gains or losses. If you’re new to speculative trading, consider practicing on a risk-free demo account before committing real money to the market.

How to Trade & Invest in Oil Assets

Oil investing and trading represent two distinct approaches to capitalizing on the future price movements of oil markets. Depending on your interest in the physical commodity or financial instruments tied to oil, there are various types of oil assets available for you to trade or invest in.

When you invest in oil, you are essentially taking ownership of the asset upfront, with the goal of profiting if the value of the commodity or shares in oil companies increases. This could involve purchasing shares in companies like BP or Shell directly or opting for a diversified oil ETF, such as the Energy Select SPDR Fund, which offers exposure to multiple oil producers within the S&P 500.

On the other hand, oil trading involves buying and selling various oil-related assets with the intention of making a profit. This can be done through contracts for difference (CFDs), which allow you to speculate on the prices of oil futures or oil-linked assets without owning the actual commodity or shares in companies and funds.

One key advantage of trading oil CFDs is the ability to profit from price movements in either direction. You can go long (open a buy position) if you anticipate that prices will rise, or go short (open a sell position) if you believe prices will fall.

Additionally, oil CFDs can be used for hedging purposes, helping to manage the risk of potential losses against gains that might be subject to capital gains tax. Hedging typically involves opening two offsetting positions, so that a loss or gain in one position counterbalances the movement in the other.

It’s important to note that CFDs are leveraged products, meaning you do not need to deposit the full value of the position when you trade. Instead, you only need to deposit a margin. However, while leverage can amplify your profits, it can also magnify your losses, so it’s crucial to approach CFD trading with caution.

Why you might want to Trade Oil & Gold?

Why you might want to Invest in OIl & Gold?

You are interested in speculating on the underlying price of Oil & Gold

You want to trade rising and falling markets – going long and short

You want to leverage your exposure

You want to take shorter-term positions

You want to hedge your portfolio

You want to trade without owning the underlying asset

You’re interested in buying and selling oil & gold stocks and ETFs

You’re focused on longer-term growth

You want to build a diversified portfolio

You want to take ownership of the underlying asset

You want to gain voting rights and dividends (if paid)

You want long-term protection from inflation.

You can take protect your wealth from the rise and fall of the Financial markets and other linked assets with this award-winning platform. You’ll get the best prices on Brent US Oil and Gold – with the lowest spreads starting from 0.02 points.

With FXMeridian, you won’t have to own the underlying asset or worry about physical delivery. At the same time, you can still buy shares in the most popular Oil & Gold refinement companies and funds or energy ETFs. It will all depend on your experience level, strategy, and risk appetite.